ShareWine Trends Q3 2025

Each quarter, we publish the ShareWine Trends report, where we comment on price developments, current trends, and interesting trading patterns based on fresh data from the marketplace and the global wine market.

Join us as we dive into the dominant trends of the third quarter of the year 🍷

Overall Trends

Trading Activity in Q3

Following a lively Q2, trading activity took a dip in July, only to reach new highs again as you all returned from summer holidays with a renewed thirst.

On the marketplace, trading activity rose steadily throughout the quarter. Compared to Q3 2024, there were 25% more trades and 38% more bids placed on ShareWine.

Is the Price Trend About to Reverse?

As mentioned in many of our recent trend reports, wine prices have been on a downward trend since November 2022. However, in the Q2 report, we spotted early signs of price stabilisation — and the question we’re asking now in October 2025 is: were those signs real? In other words, are prices in the secondary market starting to rise again?

Something suggests they might be.

In general, all the key global price indices flashed green by the end of September, with the FineWine50, FineWine100, FineWine1000, BordeauxLegends40, Burgundy150, and Rhone100 all showing price increases between 0.2–1.8%.

This is a brand-new sight after several years of consistent price declines — and a sign that the trend may finally be reversing. It's still too early to draw firm conclusions, but the indicators across the main indices are all pointing in the same direction: upward.

This is a development we’re eager to follow up on in the next edition of ShareWine Trends.

But first, let’s dive into the regional trends that have shaped Q3. Below, you can read much more about the price developments in the various wine regions.

Regional Trends

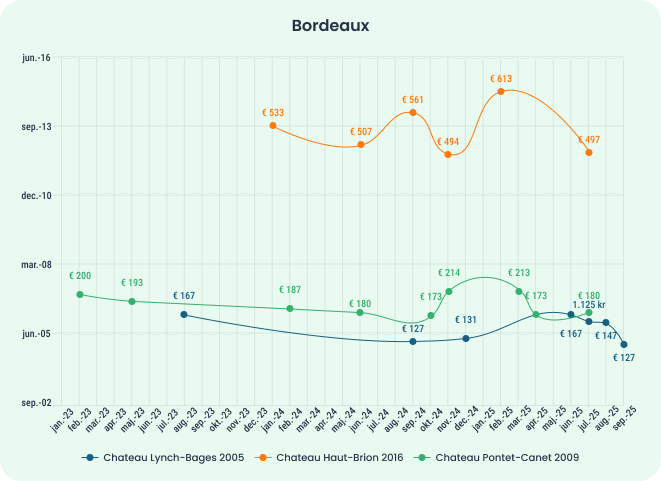

Bordeaux

The Bordeaux category performed well in Q3, with the number of trades 35% higher than the same quarter last year. Looking at the year-to-date numbers, Bordeaux sales are showing impressive growth — up 27% compared to the same period in 2024.

Prices for Bordeaux have been on a downward trend for some time, and the Bordeaux500 price index has dropped -7.2% in 2025 alone. However, in Q3, the curve flattened out completely, and rising prices in Q4 are not an unlikely scenario.

Another indicator of this is the Bordeaux Legends40 index, which specifically tracks prices for 40 legendary Bordeaux vintages post-1989. Here, prices rose 1.8% at the end of Q3.

Below you can see the price development on the marketplace for:

Château Pontet-Canet 2009

Château Lynch-Bages 2005

Château Haut-Brion 2016

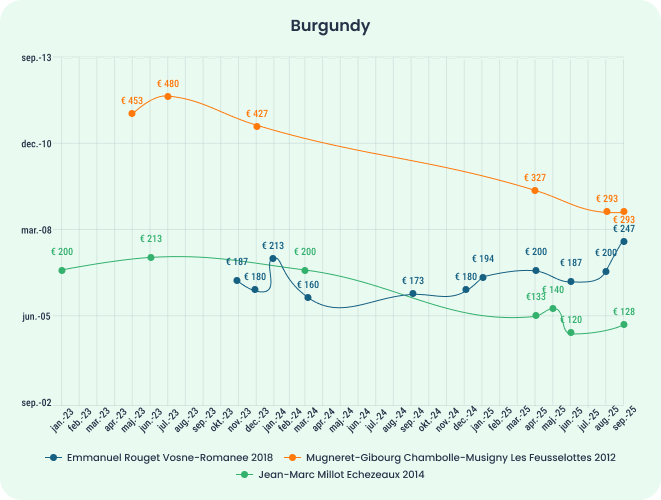

Burgundy

The Burgundy category on ShareWine has over time grown into something truly special. It’s the marketplace’s largest category, featuring wine treasures from both well-established producers and rising stars of the Burgundy scene. Thanks to many new sellers, the selection continues to flourish.

So does the interest in these wines. In Q3, the number of Burgundy wine trades was an impressive 33% higher than the same quarter last year. Truly remarkable!

The Burgundy150 price index rose 0.7% in Q3, and it will be exciting to follow developments in Burgundy, especially as the upcoming 2024 and 2025 vintages hit the market. These are expected to have low quantities — significantly lower than the current 2022 and 2023 vintages.

Want to learn more about the 2024 and 2025 vintages in Burgundy? You can read our harvest reports here.

Below you’ll find the price development for three selected Burgundy wines.

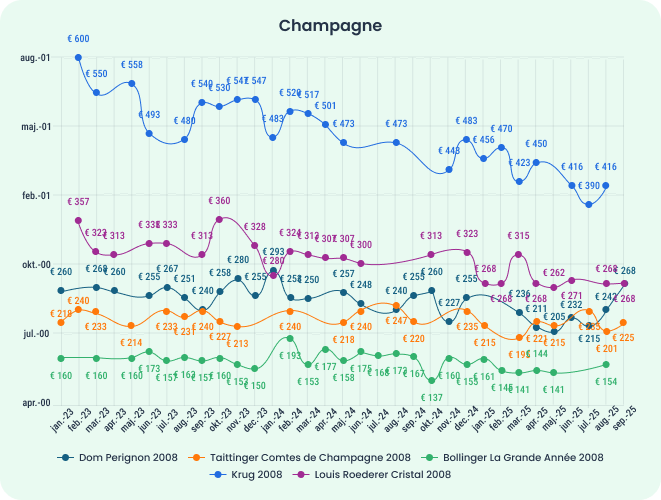

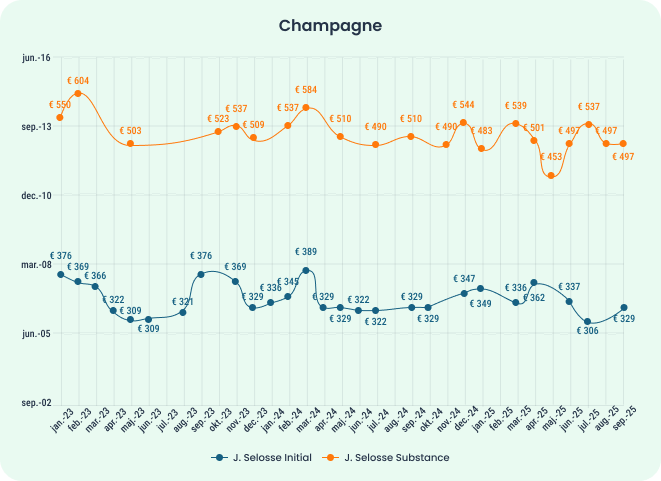

Champagne

In terms of trade volume, the Champagne category saw a noticeable decline in Q3, with 22% fewer trades than the same quarter last year. However, the total trade value was only 10% lower than last year, indicating that the average value per transaction was higher despite fewer trades.

The Champagne50 price index was one of the few to show a slight decline in Q3, down -0.2%. However, the curve has also flattened here since Q1.

Below you’ll find the price development for:

The famous 2008 vintages from five producers

Two cuvées from the legendary grower Jacques Selosse

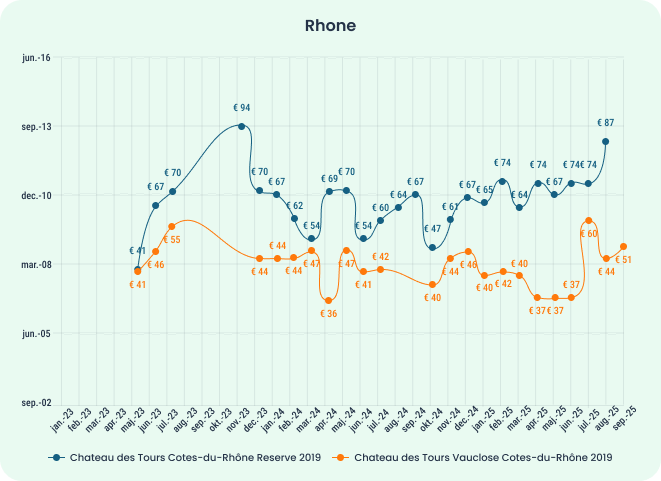

Rhône

2025 has seen a LOT of Rhône wine being traded — year-to-date, there have been 66% more Rhône wine trades compared to the same period last year. Demand has kept up with the increasing supply, and we are now seeing Rhône wines being traded at record levels across all price ranges.

From Q2 to Q3, the number of trades in this category rose 45%, and in Q3 alone, 144% more Rhône wine was traded than in the same quarter of 2024.

Popular producers such as E. Guigal, Château Rayas, M. Chapoutier, Jaboulet, and Domaine Santa Duc have all contributed to the region’s strong performance on the marketplace.

Globally, Rhône prices on the secondary market have been on a rollercoaster ride, with steep declines throughout 2023. But only now in 2025 does the Rhône100 index show signs of stabilisation, ending Q3 with a modest 0.6% increase.

Below you can see the price trends for two cuvées from Domaine des Tours.

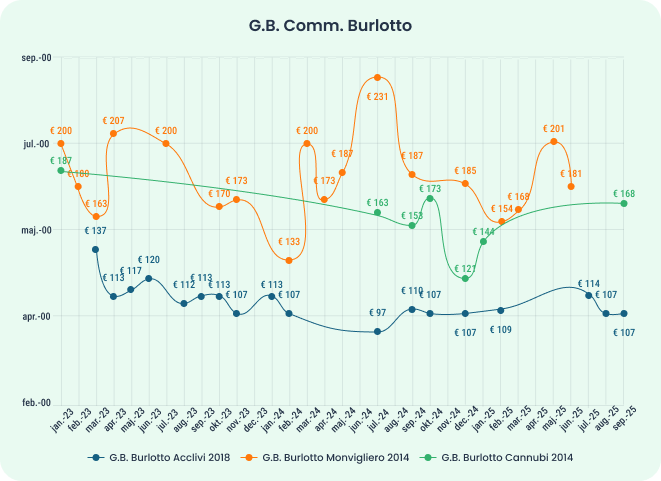

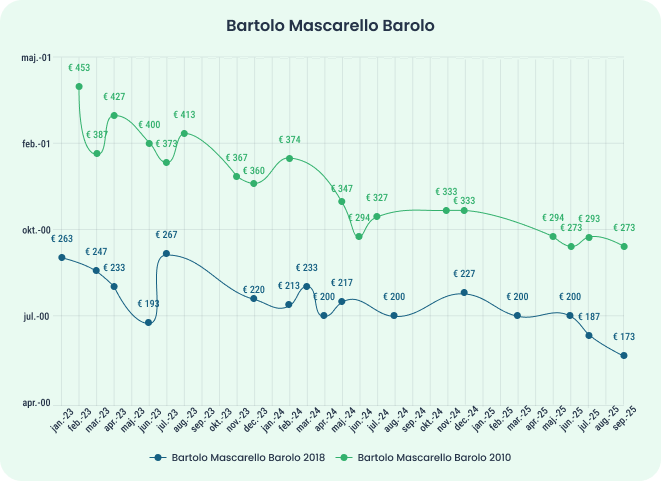

Italy

Italian wines remained popular in Q3. Compared to the same quarter last year:

28% more wine from Piedmont was traded

15% more wine from Tuscany was traded

Piedmont wines, in particular, continue to be traded in high volumes, with year-to-date figures showing a 27% increase over the same period in 2024.

The upcoming Piedmont-themed auction in October could help reinforce this trend and potentially make 2025 a record-breaking year for Piedmont wines on ShareWine. Got bottles to sell? Or are you a fan of Piedmont wines? Then mark your calendar for Thursday, October 30.

Although Italian wines have proven somewhat more resilient to the price drops seen in recent years, we’re still seeing the same flattening curve here. The Italy100 index ended Q3 with a minor decrease of -0.3%.

Below you can see the most recent average trade prices for two popular producers — one from Piedmont and one from Tuscany.

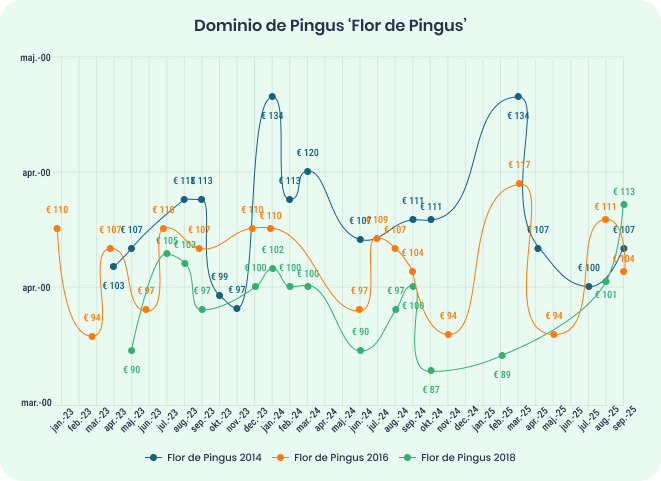

Spain

Spanish wines continue their strong momentum on ShareWine. In Q3, the number of trades was 35% higher than the same quarter last year — a clear sign of growing interest among collectors and enthusiasts alike.

Below you can see the price development for three vintages of Flor de Pingus from Dominio de Pingus.

Thank you for reading along. Join us next time as we explore the trends from what promises to be the biggest trading quarter of 2025.