ShareWine Trends Q4 2025

Each quarter, we publish ShareWine Trends, where we analyze price developments, current trends, and interesting trading patterns based on the latest data from the marketplace and the global wine market.

Join us as we dive into the data and trends from the fourth quarter and summarize the year that has passed.🍷

Highlights From the Year

A Unique Community

2025 was the year we introduced ShareWine in Italy and France – two major wine countries filled with history, traditions, and extraordinary collections. The positive reception of the ShareWine concept has shown that many have been missing a marketplace dedicated to wine enthusiasts, where wine can be traded easily and securely from cellar to cellar.

More than 7,000 new wine enthusiasts joined the marketplace during the year, and wine lovers from 20 different countries traded with each other on ShareWine. Our growing presence in Europe benefits sellers by providing greater exposure for their listings. At the same time, it becomes more exciting for buyers to explore the selection as more collectors put their wine treasures up for sale.

We enjoy seeing how bottles change hands across Europe and how tasting notes and anecdotes are shared in the chat. The passion for wine is clear, and it’s uplifting to experience the unique community that has emerged on ShareWine, where more people than ever are fulfilling their passion for fine wine.

Popular Themed Auctions Created Unique Opportunities

The monthly themed auctions were popular highlights on ShareWine in 2025, attracting significant interest. With dedicated themes, the auctions gain a special focus, allowing the history and uniqueness of specific regions to be highlighted. The strong support meant that exciting bottles were always up for sale, creating unique trading opportunities.

The program for themed auctions in 2026 is now in place and can be viewed here:

Overall Trends

Trading Activity Peaked in the Fourth Quarter

Historically, wine sales on the marketplace peak in the fourth quarter of the year. Many purchase extra wine for Christmas and New Year, while the autumn and winter tasting season requires restocking the cellar. 2025 was no exception: the number of trades increased by 39% from Q3 to Q4, and compared to the same quarter the previous year, the number of trades was 23% higher.

Price Developments Throughout 2025

We closely followed price developments in the secondary wine market throughout 2025. In summary, we observed a shifting trend in Q2, where the price declines in major global price indices began to stabilize after more than two years of constant decreases. This trend became more evident in the second half of the year, where in ShareWine Trends for Q3, we reported modest price increases of between 0.2% and 1.8% in the major price indices on Liv-Ex.

In Q4, there was either zero growth or marginal increases across the various price indices.

However, it’s worth noting that the current level remains the lowest in five years, offering great opportunities for attractive deals.

Regional Trends

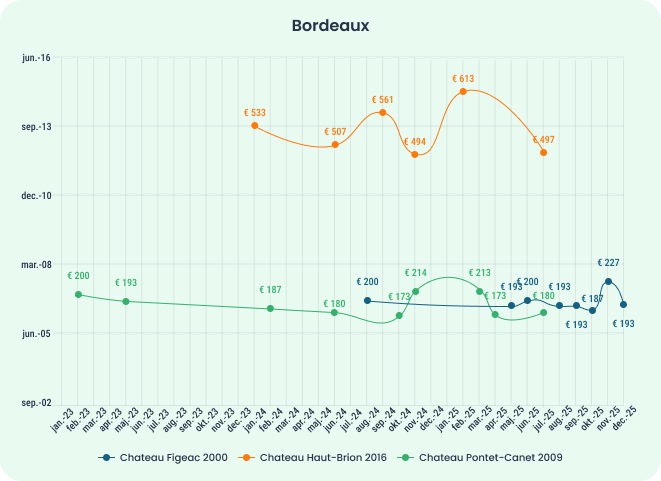

Bordeaux

Bordeaux performed well on ShareWine in Q4, with the number of trades increasing by 19% from the previous quarter. Over the entire year, the number of trades involving Bordeaux wines climbed 16%.

The Bordeaux500 price index fell by -6.7% throughout the year and ended Q4 with a flat curve. The Bordeaux40 price index, which tracks 40 wines from the strongest vintages since 1989, proved more resilient with a decline of just -2.5% over the year, ending the year with a 0.5% increase.

Below is the price development on the marketplace for Chateau Figeac 2000, Chateau Haut-Brion 2016, and Chateau Pontet-Canet 2009.

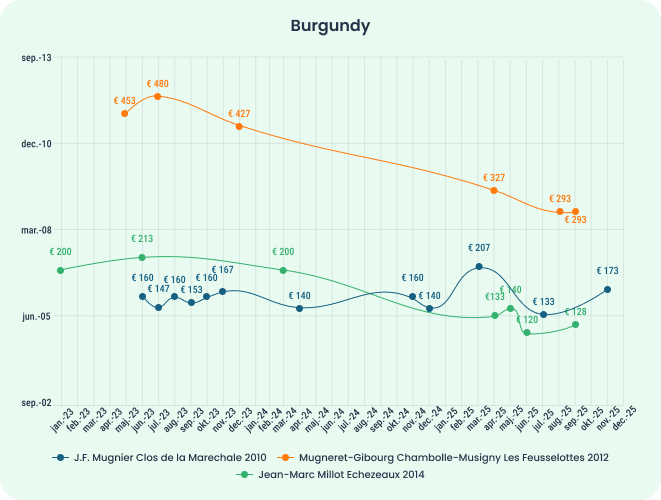

Burgundy

Demand for Burgundy wine remains enormous on ShareWine, and in 2025, the marketplace’s largest category once again set a record with a 35% increase in the number of trades.

The Burgundy150 price index fell by -4.8% during 2025, with December ending in a moderate decline of -0.4%.

Below is the price development on the marketplace for three selected Burgundy wines.

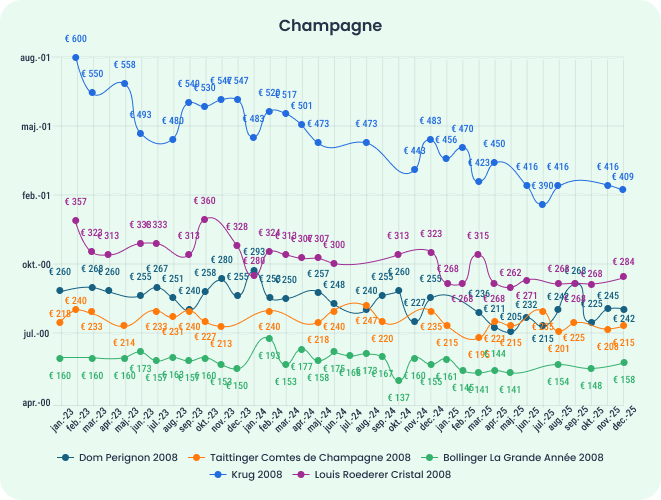

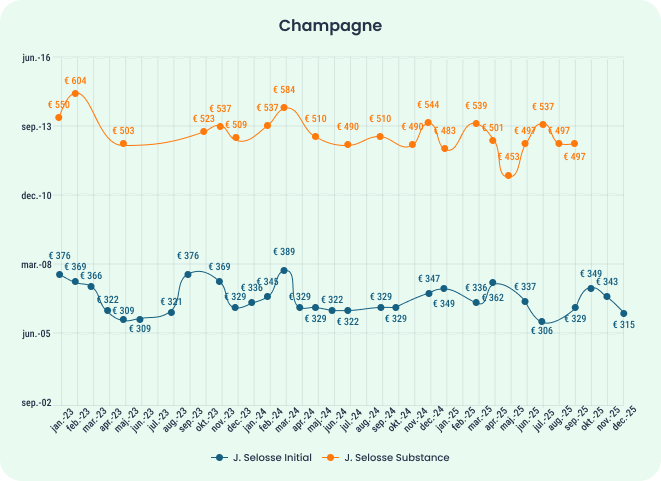

Champagne

As expected, the number of trades involving Champagne increased significantly in Q4 (91%), and compared to the same quarter in 2024, 10% more Champagne was traded in 2025.

The Champagne auction in December became the largest themed auction of the year, helping to end the year on the marketplace in style.

The Champagne50 price index followed the same trend as many other indices, with declines in the first half of the year and stabilization in the second half.

Below is the price development for the 2008 vintage from five renowned Champagne houses, as well as two cuvées from grower producer Jacques Selosse.

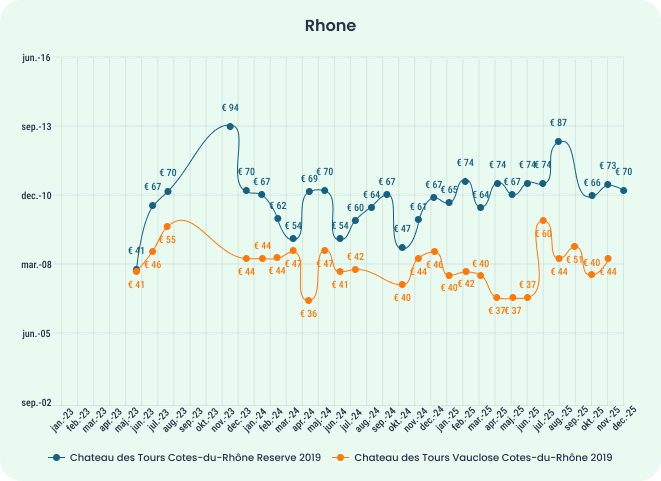

Rhone

Rhone was a true success story on ShareWine throughout 2025, with many bottles changing hands on the marketplace. In short, demand for Rhone wine was enormous throughout the year, with the number of trades increasing by 72% annually. Looking specifically at Q4, the number of trades rose by 25% from the previous quarter, and the contrast is even more striking when comparing Q4 2025 to Q4 2024, where the number of trades was 83% higher in 2025.

After some tough years, prices for Rhone wines are once again showing signs of recovery, with the Rhone100 index ending 2025 with a marginal annual increase of 0.2% and a 1.6% rise from December 2025 to January 2026.

Below is the price development for two cuvées from Domaine des Tours.

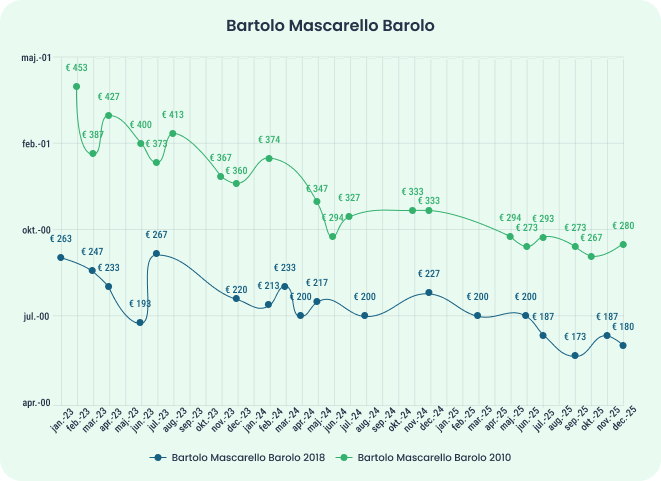

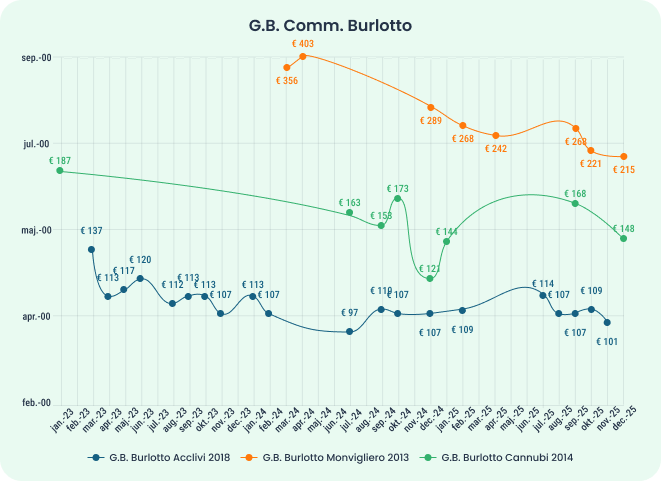

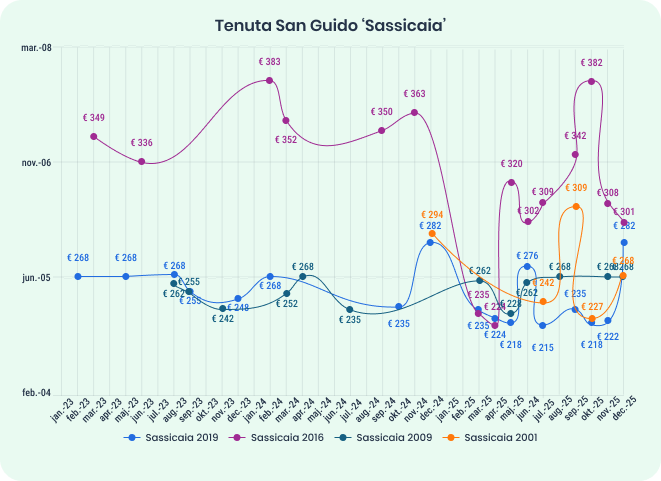

Italy

Italian wines were in high demand on the marketplace during the fourth quarter, with 50% more Italian wines traded compared to the previous quarter.

Sales of Italian wines steadily increased throughout the year on ShareWine. Wines from Piedmont saw the largest growth, with 28% more trades in 2025. Veneto followed with a 15% increase in trades, while Tuscany rose by 8%.

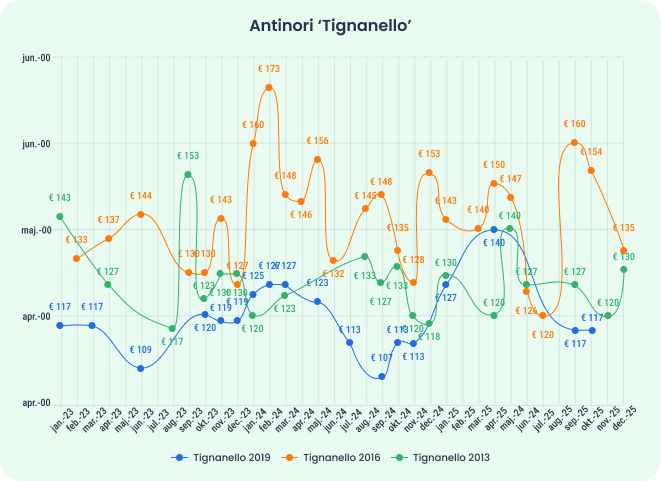

In terms of prices, the major “Super Tuscan” wines in the Italy100 price index proved more resilient to recent years’ price declines. Prices fell by just -1.7% in 2025, and over the past five years, prices remain in the positive with a 7% increase.

Below is the price development on ShareWine for a range of popular wines from Tuscany and Piedmont.

These were the trends we chose to focus on this time. We look forward to following the market closely in 2026 and reporting fresh data and trends from the first quarter in the next edition of ShareWine Trends, which will be published in April.

Thank you for reading, and happy trading!

Mikkel Lomholt

Stifter af ShareWine